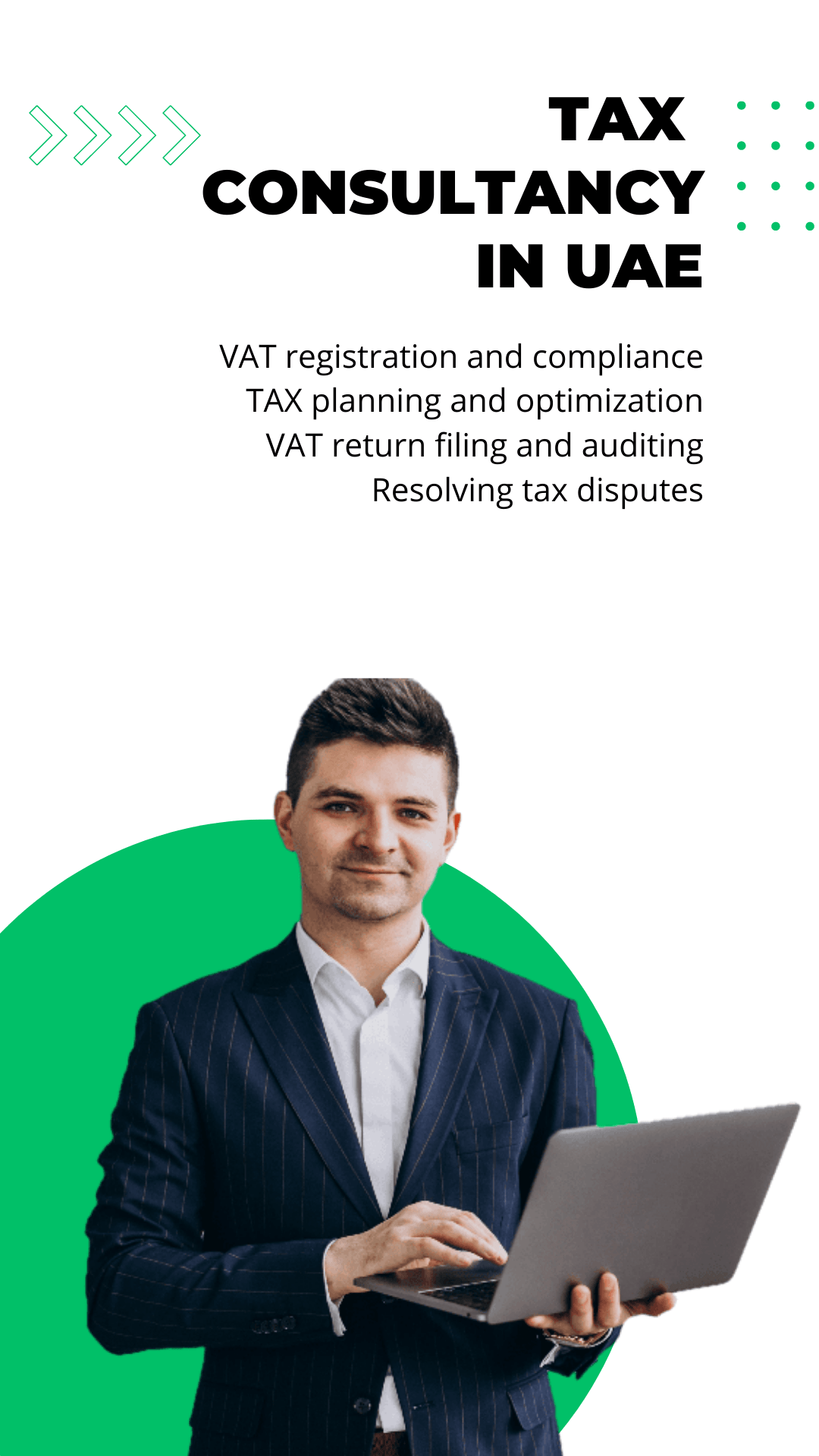

Running a business in the United Arab Emirates (UAE) entails navigating complex tax and regulatory frameworks. Value Added Tax (VAT) and tax consultancy play a crucial role in helping businesses ensure compliance, optimize their tax strategies, and avoid legal issues. In this article, we will explore the significance of VAT and tax consultancy, along with the services offered by Zara Biz Services, a trusted consultancy firm in the UAE.

VAT, or Value Added Tax, is an indirect tax imposed on the consumption of goods and services at each stage of production and distribution. It is levied in more than 180 countries worldwide, including the UAE. VAT helps governments generate revenue while shifting the burden of taxation from income to consumption. VAT regulations can be complex, and compliance is crucial to avoid penalties and legal consequences. VAT consultancy provides businesses with expert knowledge and guidance to understand their obligations, register for VAT, and maintain compliance. By staying up-to-date with evolving tax laws and regulations, businesses can ensure proper invoicing, record-keeping, and reporting.