Are you an entrepreneur with aspirations of expanding your business horizons? Look no further than the United Arab Emirates (UAE). Renowned for its thriving economy, strategic location, and investor-friendly policies, the UAE offers an ideal environment for business setup. Whether you’re a startup or an established company, the UAE presents numerous opportunities for growth and success.

In this comprehensive guide, we will delve into the essential aspects of setting up a business in the UAE. From legal requirements to visa options, we’ll provide you with all the information you need to navigate the process smoothly. Let’s dive into the world of business setup in UAE!

Table of Contents

- Business setup in UAE: An Overview

- Legal Requirements for Business Setup in UAE

- Company Types in UAE

- Local Partner Requirement

- Trade Name Registration

- Business Setup Process in UAE

- Choosing the Right Location

- Obtaining Initial Approvals

- Drafting the Memorandum of Association

- Free Zones in UAE: A Gateway to Global Markets

- Visa Options for Business Owners and Employees

- Business Licensing in UAE

- Professional License

- Commercial License

- Industrial License

- Banking and Financial Considerations

- Opening a Business Bank Account

- Taxation System in UAE

- Local Sponsorship and PRO Services

- Office Space and Infrastructure

- Employment Laws and Labor Regulations

- Intellectual Property Rights in UAE

- Marketing and Branding Strategies in UAE

- FAQ

- Can a foreigner start a business in the UAE without a local partner?

- What are the advantages of setting up a business in a UAE free zone?

- Is there a minimum capital requirement for business setup in UAE?

- How long does it take to complete the business setup process in the UAE?

- Are there any restrictions on repatriating profits from a UAE business?

- What are the popular industries for business setup in UAE?

- Conclusion

1. Business setup in UAE: An Overview

The UAE has emerged as a global business hub, attracting entrepreneurs from all corners of the world. With its strategic location between Europe, Asia, and Africa, the UAE serves as a gateway to international markets. Moreover, its political stability, world-class infrastructure, and tax benefits make it an attractive destination for business setup.

2. Legal Requirements for Business Setup in UAE

When considering a business setup in UAE, it is crucial to understand the legal requirements and regulations. Here are some key aspects to keep in mind:

2.1 Company Types in UAE

The UAE offers various company structures to cater to different business needs. The most common types are:

- Limited Liability Company (LLC): An LLC requires a minimum of two shareholders and allows foreign ownership up to 49%. It is a suitable option for small and medium-sized enterprises.

- Free Zone Company: Free zones are designated areas that offer 100% foreign ownership, tax exemptions, and simplified regulations. They are ideal for businesses targeting international markets.

- Branch of a Foreign Company: International companies can establish a branch in the UAE, allowing them to operate under their parent company’s name.

2.2 Local Partner Requirement

For certain business types, such as LLCs, having a local partner or sponsor is mandatory. The local partner must hold at least 51% ownership in the company. This requirement ensures that there is local involvement and support in business operations.

2.3 Trade Name Registration

Choosing a suitable trade name is an important step in the business setup process. The trade name should reflect the nature of your business and comply with the UAE’s naming guidelines. It is crucial to conduct a thorough check to ensure the availability of the chosen name and avoid any trademark conflicts.

3. Business Setup Process in UAE

Setting up a business in the UAE involves a systematic process that requires adherence to specific steps. Here’s a breakdown of the essential stages:

3.1 Choosing the Right Location

Determining the ideal location for your business is crucial. The UAE offers different options, including mainland locations and free zones. Free zones provide additional benefits such as 100% foreign ownership and tax advantages, making them attractive for businesses focused on international trade.

3.2 Obtaining Initial Approvals

Before proceeding with the business setup, certain approvals from relevant authorities are required. This includes obtaining initial approvals from government entities such as the Department of Economic Development (DED) or the respective free zone authority.

3.3 Drafting the Memorandum of Association

The Memorandum of Association (MOA) is a legal document that outlines the company’s structure, ownership, and activities. It is a crucial requirement for business setup in the UAE. The MOA must be drafted and notarized with the help of a legal professional to ensure compliance with UAE laws and regulations.

4. Free Zones in UAE: A Gateway to Global Markets

The UAE boasts a wide range of free zones that cater to different industries and sectors. These free zones provide businesses with numerous advantages, including:

- 100% foreign ownership

- Tax exemptions

- Easy company setup process

- State-of-the-art infrastructure

- Access to world-class facilities and services

- Simplified customs procedures

- Business-friendly regulations and policies

Some popular free zones in the UAE include Dubai Multi Commodities Centre (DMCC), Jebel Ali Free Zone (JAFZA), and Abu Dhabi Global Market (ADGM).

5. Visa Options for Business Owners and Employees

Obtaining the necessary visas for business owners and employees is a crucial aspect of the business setup process in the UAE. The UAE offers various visa categories, including:

- Investor/Partner Visa: This visa is issued to business owners and partners who hold shares in the company.

- Employment Visa: This visa is granted to employees working in the UAE. It requires sponsorship from the company.

- Freelancer Visa: Freelancers and self-employed individuals can obtain this visa to legally operate their businesses in the UAE.

Each visa category has specific requirements and documentation, and it is advisable to seek assistance from a reliable PRO service provider to ensure a smooth visa application process.

6. Business Licensing in UAE

Acquiring the appropriate business license is a crucial step in the business setup process. The type of license required depends on the nature of your business activities. Here are the main types of licenses in the UAE:

6.1 Professional License

A professional license is required for service-oriented businesses, such as consultancy firms, legal practices, and medical clinics. It is important to fulfill specific qualifications and obtain approvals from relevant authorities to obtain a professional license.

6.2 Commercial License

A commercial license is necessary for businesses engaged in trading activities, including buying and selling goods. It allows businesses to operate in the local market and import/export products.

6.3 Industrial License

Businesses involved in manufacturing or industrial activities require an industrial license. This license is necessary for companies that produce goods or engage in large-scale manufacturing operations.

7. Banking and Financial Considerations

When setting up a business in the UAE, it is essential to consider banking and financial aspects. Here are some key considerations:

7.1 Opening a Business Bank Account

Having a business bank account is crucial for managing finances and conducting transactions. UAE banks offer a range of services tailored to meet the needs of businesses, including corporate banking, online banking, and trade finance solutions. It is advisable to research and choose a bank that best suits your business requirements.

7.2 Taxation System in UAE

The UAE is known for its favorable tax environment. There is no personal income tax or corporate tax levied on businesses operating in most free zones. However, it is important to understand the tax regulations and obligations specific to your business activities and seek professional advice to ensure compliance.

8. Local Sponsorship and PRO Services

For certain business structures, such as LLCs, having a local sponsor or partner is a requirement. The local sponsor acts as a liaison with government authorities and holds a 51% ownership stake in the company. In addition, partnering with a reliable Public Relations Officer (PRO) service provider can streamline various administrative tasks, visa processing, and government liaison.

9. Office Space and Infrastructure

Choosing the right office space is crucial for establishing a physical presence in the UAE. The country offers a variety of options, including commercial buildings, business centers, and co-working spaces. Factors to consider when selecting office space include location, infrastructure, amenities, and proximity to target markets.

10. Employment Laws and Labor Regulations

Understanding the employment laws and labor regulations in the UAE is essential when setting up a business. The UAE has specific regulations governing aspects such as employee contracts, working hours, annual leave, and end-of-service benefits. It is important to familiarize yourself with these laws and ensure compliance to maintain a harmonious and productive work environment.

11. Intellectual Property Rights in UAE

Protecting intellectual property (IP) is vital for businesses operating in the UAE. The country has made significant efforts to enhance IP protection and enforcement. Entrepreneurs should consider registering their trademarks, copyrights, and patents to safeguard their innovations and creative works. Seeking legal advice from IP professionals can help navigate the registration and protection process effectively.

12. Marketing and Branding Strategies in UAE

Developing effective marketing and branding strategies is crucial for business success in the UAE market. Consider the following strategies:

- Market Research: Conduct thorough market research to understand your target audience, competitors, and market trends.

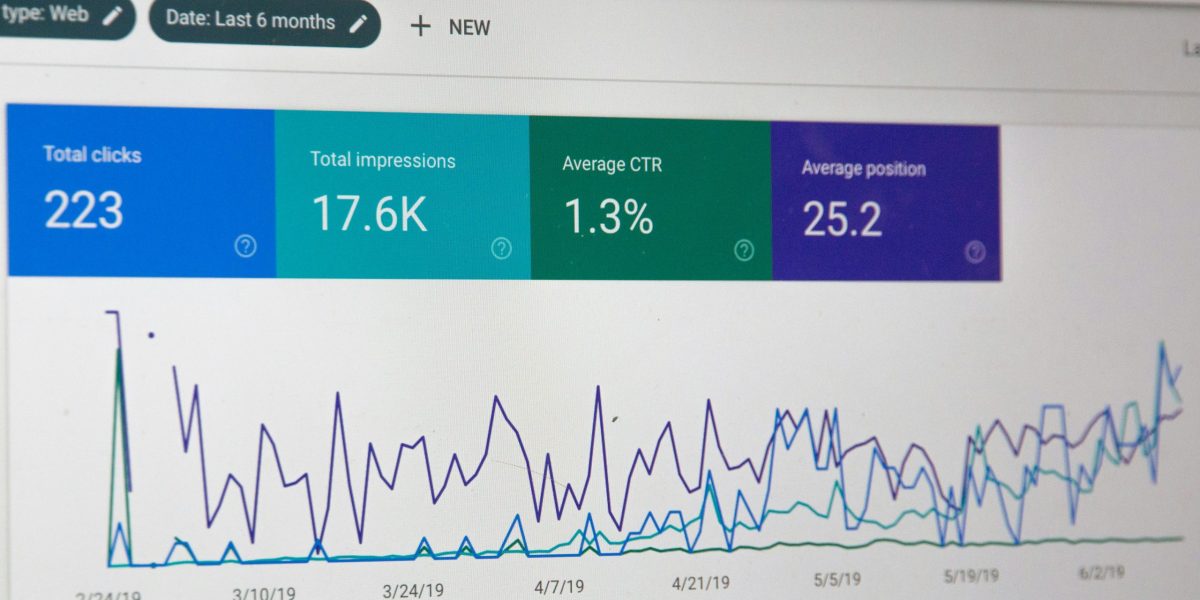

- Digital Marketing: Leverage digital platforms, social media, and search engine optimization (SEO) techniques to reach a wider audience and build brand visibility.

- Localization: Adapt your marketing messages and materials to cater to the cultural and linguistic preferences of the UAE market.

- Partnerships and Networking: Collaborate with local businesses, industry associations, and influencers to expand your network and reach potential customers.

- Customer Experience: Focus on delivering exceptional customer experiences to foster loyalty and positive word-of-mouth recommendations.

13. Frequently Asked Questions (FAQ)

13.1 Can a foreigner start a business in the UAE without a local partner?

No, certain business structures, such as LLCs, require a local partner who holds at least 51% ownership in the company. However, setting up a business in a free zone allows 100% foreign ownership.

13.2 What are the advantages of setting up a business in a UAE free zone?

Setting up a business in a UAE free zone offers several advantages, including:

- 100% foreign ownership: Free zones allow entrepreneurs to have full ownership and control of their businesses, without the need for a local partner.

- Tax benefits: Free zones offer tax exemptions on corporate and personal income taxes for a specific period, providing significant cost savings.

- Simplified regulations: Free zones have streamlined processes and fewer bureaucratic hurdles, making it easier and faster to set up and operate a business.

- World-class infrastructure: Free zones provide state-of-the-art facilities, modern office spaces, and advanced logistics and communication systems.

- Access to global markets: Free zones offer excellent connectivity and proximity to major ports and airports, facilitating international trade and access to a large customer base.

13.3 Is there a minimum capital requirement for business setup in UAE?

The UAE abolished the minimum capital requirement for most business activities in 2020. However, certain activities, such as banking, insurance, and financial services, may have specific capital requirements. It is advisable to consult with business setup experts or government authorities to determine any specific capital requirements for your chosen industry.

13.4 How long does it take to complete the business setup process in the UAE?

The timeframe for completing the business setup process in the UAE varies depending on various factors, such as the business structure, location, and complexity of the business activities. On average, it can take anywhere from a few days to several weeks to finalize the setup process. Engaging professional service providers and ensuring all required documents and approvals are in place can expedite the process.

13.5 Are there any restrictions on repatriating profits from a UAE business?

No, there are no restrictions on repatriating profits from a UAE business. Entrepreneurs can freely transfer their profits outside of the country. The UAE provides a favorable environment for conducting business and offers ease of capital and profit repatriation.

13.6 What are the popular industries for business setup in UAE?

The UAE offers diverse opportunities across various industries. Some of the popular sectors for business setup in the UAE include:

- Real estate and construction

- Hospitality and tourism

- Trading and logistics

- Information technology

- Financial services

- Healthcare and pharmaceuticals

- Manufacturing

- Consultancy and professional services

Entrepreneurs should conduct market research and assess the potential demand and competition in their chosen industry before finalizing their business setup plans.

14. Conclusion

Setting up a business in the UAE can be a rewarding venture for entrepreneurs seeking growth and opportunities. With its investor-friendly policies, strategic location, and robust infrastructure, the UAE provides a conducive environment for business setup. By understanding the legal requirements, following the necessary steps, and leveraging the available resources, entrepreneurs can navigate the process smoothly and establish a successful business in the UAE.

Remember, seeking professional guidance from company formation consultants and legal advisors is crucial to ensure compliance with local regulations and maximize the chances of success. So, seize the opportunity, embark on your entrepreneurial journey, and unlock the potential of business setup in UAE.