Starting a company in Dubai is exhilarating – you’ve got a great idea, passion to drive it forward, and hopes of being a boss. But enthusiasm alone won’t cut it in the competitive startup scene. Over 50% of new ventures fail in the first five years, often because the founders neglected financial planning and management.

The UAE has become a hotbed for entrepreneurs in recent years thanks to government-led initiatives

like the Entrepreneurial Nation strategy. Access to funding avenues, free zones, and accelerators draws

founders from around the globe. But you still need to bootstrap smartly, understand your financing

options, choose the right structure, maintain rigorous bookkeeping, and plan for sustainable growth.

This comprehensive guide will outline the key elements involved in building a financially viable company in Dubai. Follow our tips to avoid running out of cash flow or crashing from reckless expansion. With

realistic budgets, systems for managing money in and out, and step-by-step growth, your inspired idea

can turn into a thriving venture.

1. Determine Your Startup Costs

Getting an accurate handle on the capital required to launch and when you’ll face expenses before

revenue is critical. Many entrepreneurs underestimate how much they need. Be meticulous with

projections around:

- Initial equipment purchases & software needs – Will you buy or lease physical equipment like

machinery, fleet vehicles, and salon chairs? Factor in shipping/installation. Price any specialized software programs. - Renting commercial workspace & utilities – Look at current leasing rates per square foot in your target location & scale up for future needs. It is very important to make a Budget for installation costs.

- Inventory production/purchasing – Estimate raw material and packaging costs based on units needed. Include shipping/storage fees.

- Licenses, permits, legal/professional fees – License costs vary by industry and location. Consult lawyers & accountants early about expected fees.

- Marketing activities & materials – Budget for website development, graphic design services, printed

collateral, digital ads, and trade show booths. Don’t skimp on branding & promotions! - Salaries, Wages and benefits – Project realistic talent needs from operations to sales. Understand

prevailing wages & legally required benefits like yearly airfare allowance. - Aim higher with estimates – Buffer at least 20-30% for unforeseen expenses and contingencies that will arise. Financial cushions are essential given how many startups don’t become profitable for 1-2 years. Build out 12-24 month projections.

Getting quotes from other businesses and suppliers in your sector provides benchmark figures. Reach

out to founders of similar ventures to understand the costs they incurred. Refine budgets continually –

financial tracking will uncover new requirements.

2. Understand Your Funding Options

With accurate numbers around startup costs in hand, securing enough capital to cover expenses until

you turn a profit is crucial. First, when you think of opening a company in Dubai, decide if you can self-fund through:

- Personal Savings – Tapping personal assets allows full control but is limited. Have at least a year’s worth of operating expenses.

- Bootstrapping – Funded by early operations & rigorously lean spending rather than external financing. You grow slower. If you need to raise money externally, common approaches include:

- Crowd funding Campaigns – Create pitches for backers/the crowd to support your idea financially. It provides fundraising momentum.

- Startup Accelerators – These boot camp-style programs provide mentorship, resources, workspace, and often grant funding or investment in exchange for equity.

- Incubators – Similar to accelerators but more flexible programs supporting startups through initial stage. Also competitive and take equity.

- Venture Capital Firms – Institutional investors pooling money from entities like banks or pensions. Require detailed business plans and pitches with traction.

- Bank Loans – Banks provide funding based on strict criteria – from business plans to collateral/assets. Require personal guarantees by founders.

- Government Grants – Some government agencies offer incentives like subsidized loans, wage support, or awards programs. Extensive applications for loans with limited funding.

A prudent startup fundraising strategy combines several sources pursued in parallel – perhaps crowd

funding, accelerator grants, and bank loans. This diversifies risk rather than relying on one. The Craft

systematic applications for each based on clear financial projections.

3. Choose a Business Structure

Determining the right corporate structure early on sets your venture on good legal and financial footing.

Consult with business lawyers and tax professionals to pick between common options.

- Sole Proprietorship – Simplest if you’re the only owner but have little legal protection. All income passes through to your taxes.

- Limited Liability Company (LLC) – Adds legal and tax flexibility for multiple owners but is more expensive to establish/maintain.

- Branch of a Foreign Company – If the parent company is based abroad, easier to set up a new entity rather than a branch office but it has less autonomy. Other corporate structures like joint ventures, holding companies, or representative offices carry specific purposes, advantages, and complex requirements in the UAE.

Key considerations around structure include:

- Personal assets protection – LLC status separates business and personal assets for better liability shielding but costs more.

- Tax treatment – LLCs are taxed only at the corporate entity level initially. Sole proprietors are directly liable.

- Ownership flexibility – LLCs allow more diverse shared ownership between multiple founders.

- Administrative needs – Proper structuring as per Department of Economic Development and Free Zone agency policies. Yearly filings and meticulous record-keeping required.

- Visas allotment – Business setup enables investor/partner residence visas.

In the UAE, LLCs are the most popular for the mix of advantages but require thorough compliance. Free

Zone entities have reduced paperwork/capitalization burdens in exchange for licensing restrictions.

Seeking expert guidance around the best structure that aligns with your activities, team, and objectives

saves money and hassles long term.

4. Manage Bookkeeping

While not glitzy, setting up professional accounting practices ensures you closely monitor the true

financial state and viability of your business. Delaying proper fiscal discipline can severely hurt growth

prospects. Core elements include:

- Financial Statements – Produce monthly profit/loss statements, balance sheets, and cash flow reports. Master how to analyze these to direct decisions.

- Accounting Software – Tons of affordable cloud-based programs today for solo entrepreneurs or larger teams.

- Bookkeeper Vs DIY – Consider outsourcing the heavy lifting of entries, categorization, bill payments, and reporting based on time/skills constraints.

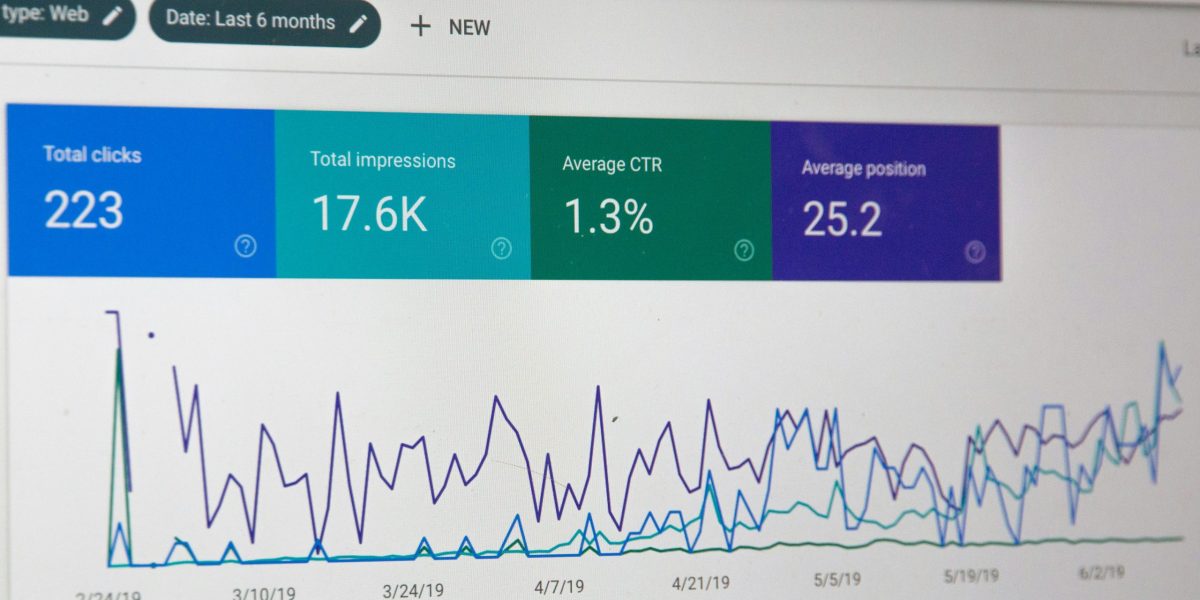

- Key Metrics – Beyond old-school P&Ls track emerging metrics like customer acquisition cost, lifetime value, and churn rate.

- End-of-year Requirements – Tax declarations, profit sharing with investment partners, and proper documentation for government authorities.

While bootstrapping initially, don’t ignore financials but rather diligently project, measure, assess and

guide the venture forward based on real economics. Establish processes early on rather than untangling

poor records down the road.

5. Plan for Long-Term Profit and Growth

The startup adrenaline rush carries you for the first year when you open a company in Dubai– but building for the long haul based on methodical growth and responsible scaling will determine ultimate success:

- Strategic Expansion Phases – Map out incremental geographic growth or new products/services rather than premature rapid moves that expose vulnerabilities. Consider 3-5 year horizons.

- Milestone Targets – Set specific operational and financial objectives for the next stages – customers, conversion rates, subscriptions booked. That helps maintain focus.

- Reinvest Earnings Vs Personal Draws – Plow early profits back into product development, talent, and other scale enablers. Be conservative in paying yourself until growth stabilizes.

- Cautious Hiring – Only take on more staff once revenue from the last hires kicks in dependably. Otherwise stretched resources drain momentum quickly.

While tempted to expand aggressively when signs look positive, moderate deliberate growth anchored

to metrics prevents “too much too fast” pitfalls sinking overly ambitious startups. Stay true to core

competencies and align expansion to long-term strategic vision.

6. Consider Tax Implications

Taxes apply from the earliest days of preparing to launch in the UAE and will dictate costs, where to

domicile activities, and liability throughout operations – so founders must educate themselves properly

on current regulations.

Business income tax also applies but the threshold depends if operating inside mainland or Free Zones.

Personal income tax does not currently exist in UAE but regulations continually evolve. Withholding

taxes on amounts paid to foreign partners/shareholders requires planning.

Given the financial implications, engage a reputable accounting firm from the outset to ensure full

compliance across all tax filings and payments. Don’t risk non-compliance fines that jeopardize delicate

cash flows for early-stage ventures. The cost is well worth it for peace of mind.

Conclusion

Launching a profitable, sustainable venture requires grit, creative thinking, and likely some pivots. But

the foundation for seizing opportunities relies on buttoned-up financial planning and management.

Neglect startup budgeting, funding pursuits, structural considerations, bookkeeping, and moderate

growth at your peril in the competitive UAE marketplace.

Hopefully, this guide has provided a roadmap of the key financial elements to address from Day 1 before starting a company in Dubai. Master these practices, and align with quality advisors, accelerators, free zones, and incentive programs, and your entrepreneurial dreams can defy those daunting failure rate statistics. For further help developing your customized financial playbook or making the right connections to launch confidently, consult specialized startup consultants ZARA Biz Services.

Their experienced founders have helped over 500 ventures incorporate properly, build funding pipelines, and establish operational best practices. Through meticulous Financial Planning, they empower entrepreneurs to focus on what they do best.

I really enjoy the blog articleMuch thanks again Fantastic